🏠 30-Year Mortgage Rates Hit Near One-Year Low

Just in a flash, 30-year mortgage rates have dipped to a level we haven’t seen in almost a year. This opens up a smart chance for folks to secure a more wallet-friendly mortgage right before the next Federal Reserve decision might stir things up and push borrowing costs around again.

📉 What Changed

Looking at national benchmarks, there’s a sharp drop in mortgage rates lately. The average 30-year fixed rate has slipped into the mid-6% territory—the biggest weekly slide in roughly a year, based on Freddie Mac’s survey and matching reports from various media outlets. Trackers across the board now show average 30-year mortgage rates hovering between 6.3% and 6.35%, a solid step down from over 7% earlier this year. This eases the burden for home buyers and those looking to refinance.

🔍 Why Rates Dropped

A softer August jobs report and signs of cooling inflation dragged the 10-year Treasury yield lower, which is the main force behind 30-year mortgage rates. Even with markets betting on a Fed rate cut at the next meeting, this pullback happened. Remember, the Fed doesn’t directly control mortgage rates, but what people expect from their decisions affects bond yields, and those flow straight into the U.S. housing market through everyday pricing on standard loans.

📊 Where Rates Stand Now

As we hit mid-September, key trackers point to the 30-year mortgage rate averaging around 6.32% to 6.35%. For 15-year fixed, it’s in the mid-5% zone, and jumbos are sitting in the mid-6% area too—showing relief across the board. The Mortgage Bankers Association’s latest survey has the average contract rate at 6.49%, the lowest point since October 2024, highlighting just how deep this recent dip has gone among lenders and channels.

📈 Recent 30-Year Averages Data Table

| Week Ending | Average 30-Year Fixed |

|---|---|

| 2025-08-14 | 6.62% |

| 2025-08-21 | 6.58% |

| 2025-08-28 | 6.56% |

| 2025-09-04 | 6.50% |

| 2025-09-11 | 6.35% |

Source: Freddie Mac’s Primary Mortgage Market Survey and FRED’s MORTGAGE30US series

❓ Will They Climb Again?

Markets are super tuned to fresh data and what the Fed says next. With their rate decision coming up soon, yields and mortgage prices could bounce around based on policy hints and whether cuts keep coming or hit a pause. Experts note that a lot of the anticipated easing is already baked in, so the next shift in 30-year mortgage rates will really depend on if economic numbers on inflation and growth catch us off guard compared to what we expect.

💰 What This Means for Mortgage Affordability

Even small tweaks in rates can mean big cuts to monthly payments on a typical home, pulling more buyers back into the game and ramping up applications for buying or refinancing. The latest MBA figures show a surge in applications now that rates are at this near one-year low, proving that better affordability is already sparking more action in the U.S. housing market.

🏡 Real-Life Case Study: “The Austin Lock”

Picture a buyer in Austin eyeing a $500,000 home with 20% down. Back in early August, they got quoted 6.75%, but last week, after seeing 30-year mortgage rates slide with the Treasurys before the Fed meeting, they locked in at 6.35%. That 40 basis point drop shaves over $100 off the principal-and-interest payment each month. It was enough to help them qualify and move forward, just before any post-Fed jitters might push prices up on nearby new listings.

🛡️ Strategy: Act, Then Optimize

If you’re shopping to grab this recent mortgage rate drop, get same-day quotes from several lenders and think about float-down options to snag more if rates keep easing after you lock. Since markets have factored in a cut already, it’s wise to lock when you see a good rate and keep some wiggle room on appraisal and closing timing to handle any ups and downs after the policy news lands.

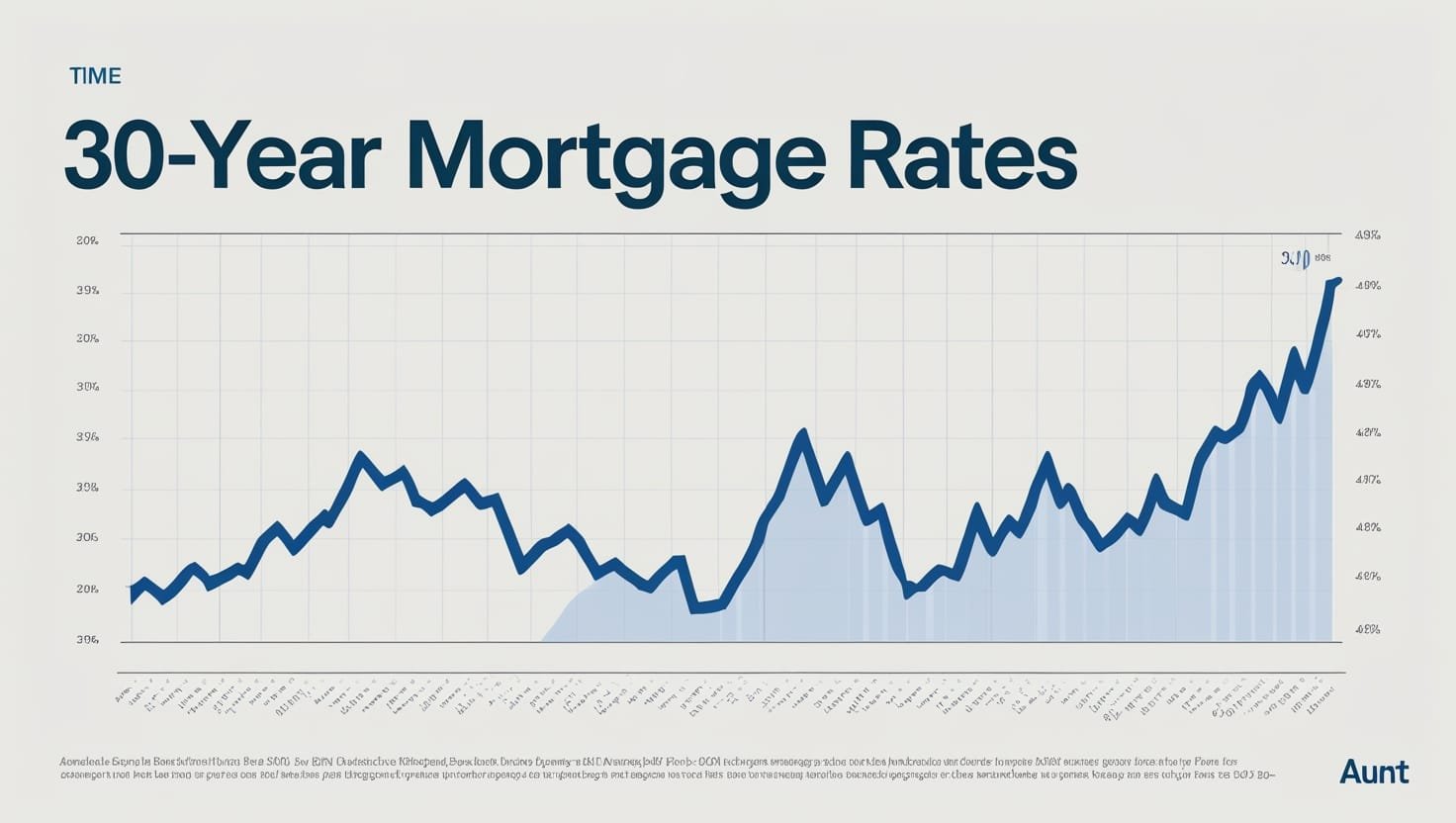

📊 Chart Note: Average U.S. 30-Year Fixed Mortgage Rate

The rate fell 15 basis points week-over-week to 6.35% as of September 11, 2025. This tracks with the downward trend from around 6.56% in late August.

Source: Freddie Mac and FRED data

🔮 Outlook for the U.S. Housing Market

Cheaper borrowing should prop up demand and help homes turn over a bit faster, but affordability really comes down to local supply and how home prices are moving—especially since rates are still higher than before 2022. Most pros predict rates will stick around the mid-6% mark, with some swings tied to new data drops. Expect steady steps forward rather than a huge leap, unless the economy slows way down.

📝 Bottom Line

With 30-year mortgage rates touching a near one-year low and a key Fed decision on the horizon, this could be your moment to lock in before things shift again. It’s especially helpful for borrowers who stand to save a bunch from these modest improvements. Get your docs ready, shop rates across lenders on the same day, and double-check lock details plus any float-down possibilities to make the most of this affordability boost in such a quick-changing market.

❓ FAQs

What are 30-year mortgage rates today?

Most trackers show 30-year mortgage rates near the mid-6% range as of mid-September 2025, with several sources citing around 6.32%–6.35% on average.

Why did we see a recent mortgage rate drop?

Rates fell as the 10-year Treasury yield declined on softer jobs and cooling inflation data, with markets also pricing in a Fed cut at the upcoming meeting.

How does the Fed rate decision affect the 30-year rate?

The Fed doesn’t set mortgage rates directly, but policy expectations influence Treasury yields, which are the primary driver of 30-year mortgage rates.

Is now a good time to lock before they climb again?

Given the near one-year low and potential post-Fed volatility, many borrowers are choosing to lock now while confirming options to float down if rates fall further.

What does this mean for mortgage affordability and the U.S. housing market?

Lower rates meaningfully improve monthly payments and have already boosted applications; this supports activity, though affordability still hinges on local prices and supply.

🌐 Explore More on Global Market Today

Dive deeper into the latest updates, insights, and expert analysis across our most popular categories.

Stay informed on business, economy, AI, and more – all in one place.

📈 Market

💼 Business

🏛️ Politics

🤖 Artificial Intelligence

🔧 Technology

₿ Cryptocurrency

🌍 Economy

💰 Personal Finance

⚡ Fintech Tools

Hindi Version