Top 10 Personal Finance Books That Will Change Your Money Mindset

“The purpose is not more money. The purpose is living life on your terms.”

We all want financial freedom, but most of us were never educated on how to manage money. The best part? It’s never too late to start. Whether you’re a college student, a young professional, or someone in your 30s or 40s looking to level up your financial life — the right book can completely shift your mindset about money.

Here’s a list of the top 10 personal finance books that will make you change the way you think, feel, and act with money. These are ideal for Indian millennials, but honestly, anyone who wishes to improve their money habits will find these useful.

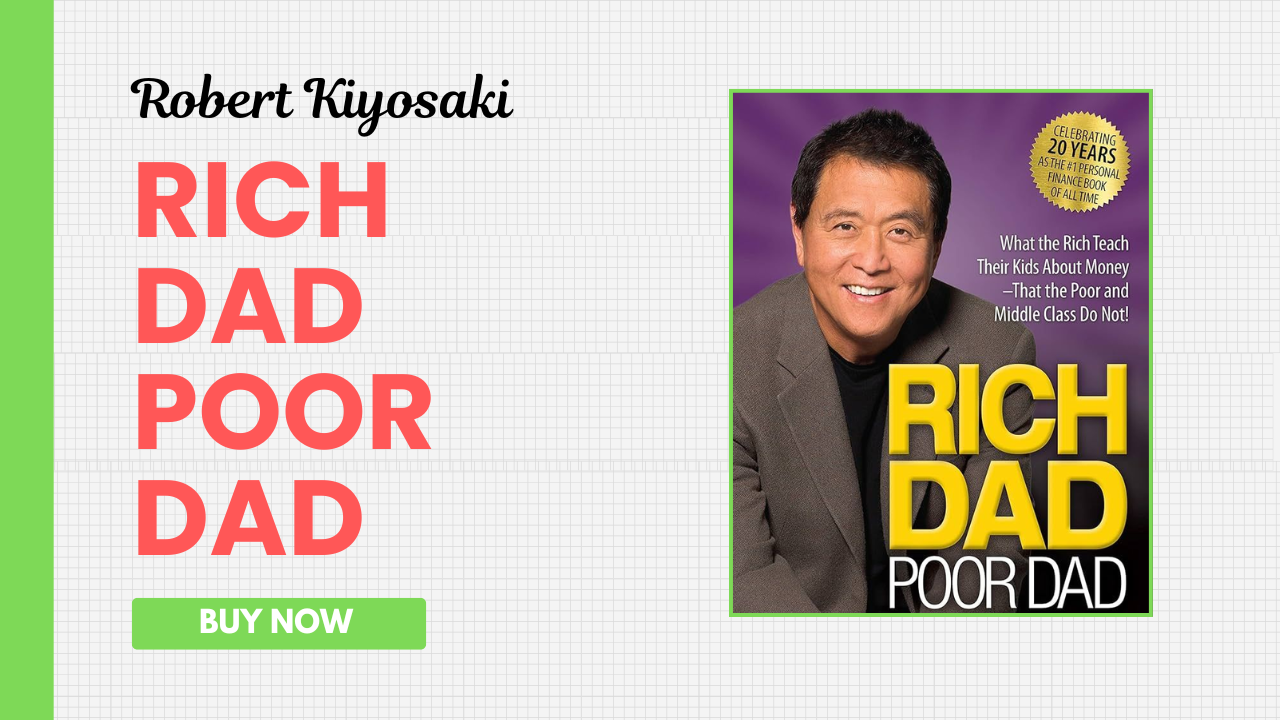

1. Rich Dad Poor Dad by Robert Kiyosaki

Why Read It:

This book is a mindset shift in disguise. Kiyosaki compares the teachings of his rich dad (his friend’s father) and his poor dad (his biological father). One focused on assets, the other on degrees.

Key Lessons:

The rich buy assets; the poor buy liabilities, thinking they’re assets.

Don’t work for money; make money work for you.

Financial education is more important than a high-paying job.

Ideal For:

Beginners who want to break free from the traditional job trap and start thinking like an investor.

2. The Psychology of Money by Morgan Housel

Why Read It:

It’s a book about how feelings, behavior, and individual experience influence our money choices. It’s not only numbers and reason—it’s human.

Key Lessons:

Getting rich is a matter of strategy; remaining rich is a matter of behavior.

You don’t have to be brilliant, but just consistent and persistent.

Wealth is what you don’t see (your savings, not your expenses).

Ideal For

Anyone seeking a peaceful, pragmatic, and philosophical way of dealing with money.

3. I Will Teach You to Be Rich by Ramit Sethi

Why Read It:

Designed particularly for young professionals, the book is akin to a no-holds-barred chat with an intelligent, quick-witted buddy. Ramit simplifies personal finance and makes it fun.

Key Lessons:

Automate savings and investments.

Spend lavishly on things you enjoy, and slash ruthlessly on things you don’t.

Create a guilt-free and aware money system.

Ideal For:

Indian millennials who desire a proper, contemporary financial system to become rich without being cheap.

4. The Millionaire Next Door by Thomas J. Stanley & William D. Danko

Why Read It:

It dispels the myth that millionaires lead extravagant lifestyles. In reality, most millionaires live relatively simply and save prudently.

Key Lessons:

Wealth is the outcome of hard work, discipline, and regular saving.

High income ≠ wealth.

Steer clear of lifestyle inflation and excessive show-off spending.

Recommended For:

Anyone who believes wealth is all about income. You learn from this book that wealth is created quietly and steadily.

5. Your Money or Your Life by Vicki Robin & Joe Dominguez

Why Read It:

Your Money or Your Life makes you question your association with money and time. It’s deep, honest, and a life-changing read.

Key Lessons:

Money = life energy. Every rupee spent is a part of your life.

Account for every expense and wonder, “Is it worth it?”

Strive for financial independence, not just more income.

Ideal For

Those burnt out from the grind and want to make life simpler yet still achieve freedom.

6. Think and Grow Rich by Napoleon Hill

Why Read It:

While not a standard personal finance title, it’s an oldie but a goodie on wealth mindset and how good thoughts and good habits generate riches.

Key Lessons:

Desire + believing = action → results.

Consistency is what makes success rise above failure.

Create a burning desire and visualize yourself succeeding daily.

Best For:

Entrepreneurs, dreamers, and anyone who believes that mindset is the beginning of financial prosperity.

7. The Intelligent Investor by Benjamin Graham

Why Read It:

Warren Buffett calls this his investment bible. If you must know about value investing, this book is pure gold.

Key Lessons

The market is a voting machine in the short term, a weighing machine in the long term.

Don’t guess. Invest with a margin of safety.

Patience is your superpower.

Ideal For:

Anyone willing to move from saving to investing and would want to understand stock market logic sans hype.

8. Dollars and Sense by Dan Ariely & Jeff Kreisler

Why Read It:

A highly engaging, evidence-based book that uncovers the sneaky mental traps we automatically fall into while dealing with money.

Key Lessons:

We are emotional spenders, not logical.

We fall prey to anchoring, freebies, and sunk cost fallacy while spending.

Being aware is the very first step in making wiser money decisions.

Ideal For

Anyone who will find themselves saying, “Why do I constantly spend money on things I don’t need?” This book tells you why—and how to stop it.

9. The Barefoot Investor by Scott Pape

Why Read It:

It’s simple, friendly, and very earthy. Scott nakedly strips away financial freedom into simple steps and habits.

Key Lessons:

Automate buckets of money: essentials, splurge, smile, and fire-extinguisher.

Invest with as little as a few hundred rupees.

Cover yourself and have an emergency fund.

Best For:

Indian millennials are looking for a simple, step-by-step guide to financial health.

10. The Latte Factor by David Bach

Why Read It:

Taking a novel approach, this book puts forward a jaw-dropping reality: small habits create giant wealth if you do it for an extremely long time.

Key Lessons:

You are richer than you think.

Pay yourself first.

The small stuff (like your morning coffee) accumulates—invest it instead.

Ideal For:

Anyone who feels they “don’t earn enough to save” or struggles to get started with money.

How These Books Can Transform Your Life

Reading just one of these books can change your perspective. But reading several? That’s a total money mindset makeover. Here’s how:

You’ll Stop Living Paycheck to Paycheck

With automation, conscious spending, and better money habits, you’ll start building wealth effortlessly.

You’ll Feel Powerful, Not Apprehensive

Money consciousness is power. You will never dread bills, debt, or money emergencies.

You’ll Invest Smart

These books, like The Intelligent Investor or Rich Dad Poor Dad, make you realize the value of assets and thinking in terms of the long term.

You’ll Value Time Over Money

Most of them instruct you that money is a tool. Freedom, peace, and purpose matter.

Bonus Tips to Get the Most Out of These Books

Take Notes: Write down insights and maintain a money diary.

Apply Immediately: Reading is pointless if you don’t implement it.

Discuss with Friends: Establish a finance book club—it makes learning enjoyable and accountable.

Revisit Yearly: Each revisit adds additional value, particularly as your life evolves.

Final Thoughts

Money is not about numbers—it’s about behavior, attitude, and clarity. These 10 personal finance books are not just for reading. They’re for living.

If you want to change your money future, begin with one of these books. Implement one idea. Create one habit. And before you know it, you’ll sit back and say—your money mind has entirely changed.