How AI Is Revolutionizing Sustainable Finance with ESG & Risk Models 🤖🌿

In an era defined by increasing environmental consciousness and social responsibility, the financial sector is undergoing a profound transformation. Sustainable finance, once a niche concern, has rapidly evolved into a mainstream imperative, driven by growing investor demand, regulatory pressures, and a deeper understanding of the intrinsic link between sustainability and long-term value creation. At the heart of this evolution lies the burgeoning influence of artificial intelligence (AI). AI is not merely an auxiliary tool; it is a fundamental catalyst, reshaping how financial institutions approach environmental, social, and governance (ESG) considerations and manage associated risks. The integration of AI in sustainable finance is unlocking unprecedented capabilities, from granular data analysis to predictive modeling, enabling more informed, impactful, and resilient investment decisions. This article delves into the multifaceted ways AI is revolutionizing sustainable finance, exploring its pivotal role in enhancing ESG frameworks, refining risk models, and fostering a new era of green investing.

AI’s Transformative Role in ESG Data and Risk Modeling 📊

The sheer volume and complexity of ESG data present significant challenges for financial institutions. Traditional methods of data collection, analysis, and reporting are often manual, time-consuming, and prone to inconsistencies. This is where AI steps in as a game-changer, offering sophisticated solutions to streamline these processes and enhance the accuracy and depth of ESG insights. AI-powered platforms can ingest and process vast amounts of structured and unstructured data, including corporate reports, news articles, social media, and satellite imagery, to extract relevant ESG information.

One of the primary contributions of AI is in automating ESG data collection and analysis. Natural Language Processing (NLP) algorithms, a subset of AI, can parse through extensive textual data to identify ESG-related keywords, sentiments, and disclosures. This capability allows for the rapid assessment of a company’s ESG performance, identifying both strengths and weaknesses that might otherwise remain hidden. Machine learning models can then be trained to categorize and score companies based on their ESG attributes, providing a more objective and consistent evaluation than human-driven processes. This automation significantly reduces the time and effort required for ESG due diligence, enabling financial professionals to focus on strategic decision-making.

Beyond data collection, AI is revolutionizing ESG risk modeling. Climate change, for instance, poses significant physical and transition risks to financial assets. AI models can integrate complex climate science data with financial metrics to predict the potential impacts of climate change on specific industries, companies, and portfolios. These models can simulate various climate scenarios, assess the vulnerability of assets to extreme weather events, and quantify the financial implications of carbon transition policies. This advanced analytical capability allows investors to better understand and price climate-related risks, leading to more resilient investment strategies. For example, AI can analyze satellite imagery to monitor deforestation rates or water stress in supply chains, providing real-time insights into environmental risks that directly impact a company’s long-term sustainability. 🛰️

Case Study: EnerSys and AI-Powered ESG Data Management 📈

A compelling real-life example of AI’s impact on ESG data management comes from EnerSys, a global leader in stored energy solutions. EnerSys leveraged an AI-powered platform to significantly enhance the efficiency and accuracy of its ESG data collection, reporting, and analysis. The company faced the common challenge of managing diverse data sources across its global operations, making it difficult to consolidate and report on key ESG metrics effectively. By implementing an AI-driven solution, EnerSys was able to automate the extraction of critical information from various documents, including utility bills from its 180 global sites. This automation, facilitated by machine learning, allowed EnerSys to accurately calculate its greenhouse gas (GHG) emissions and other resource footprints, leading to a more robust and transparent ESG reporting process. This case study underscores how AI can transform tedious manual processes into efficient, accurate, and scalable solutions, ultimately improving a company’s ability to measure and manage its sustainability performance. 🔋

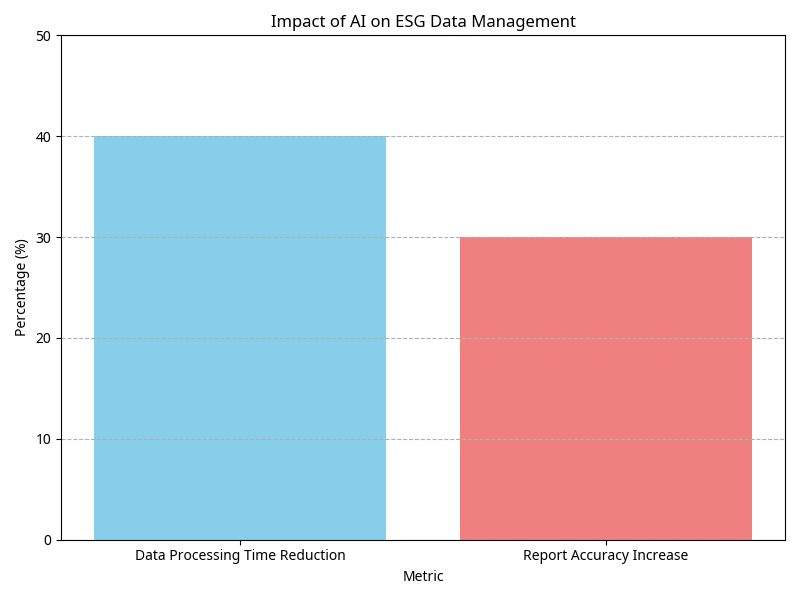

Impact of AI on ESG Data Management 📉

AI’s influence extends to tangible improvements in operational efficiency and data quality within ESG frameworks. Studies and industry reports indicate that companies adopting AI for ESG data management have experienced notable benefits. The following table and chart illustrate some key impacts:

| Metric | Value (%) |

|---|---|

| Data Processing Time Reduction | 40 |

| Report Accuracy Increase | 30 |

This data highlights the significant efficiencies gained through the application of AI, leading to faster processing of ESG data and a marked improvement in the accuracy of sustainability reports. These advancements are crucial for financial institutions and corporations striving to meet increasing regulatory demands and stakeholder expectations for transparent and reliable ESG disclosures. 💹

Data Processing Time Reduction: 40%

Report Accuracy Increase: 30%

AI and the Future of Green Investing 🌱

Green investing, or sustainable investing, focuses on allocating capital to companies and projects that contribute positively to environmental sustainability. AI is playing an increasingly vital role in identifying, evaluating, and managing these investments, making green finance more accessible, efficient, and impactful. Traditional green investing often relies on broad sector exclusions or limited data sets, which can lead to missed opportunities or unintended exposure to unsustainable practices. AI, with its ability to process vast and diverse data, offers a more nuanced and dynamic approach.

AI algorithms can analyze a company’s entire value chain to assess its true environmental footprint, going beyond self-reported data. For instance, AI can process satellite imagery to monitor land use changes, track emissions from industrial facilities, or evaluate the health of ecosystems surrounding a company’s operations. This granular level of analysis provides investors with a more accurate picture of a company’s environmental performance and its alignment with green objectives. Furthermore, AI can identify emerging green technologies and innovative solutions that might otherwise be overlooked, presenting new avenues for sustainable investment. 💡

In portfolio management, AI enables the construction and optimization of green portfolios that align with specific sustainability goals and risk appetites. AI models can dynamically adjust portfolio allocations based on real-time ESG data, market trends, and regulatory changes. This allows for proactive management of green investments, ensuring that portfolios remain aligned with evolving sustainability standards and investor preferences. For example, AI can help identify companies that are genuinely committed to renewable energy transitions versus those engaged in ‘greenwashing’ – a practice where companies deceptively present themselves as environmentally friendly. By analyzing public statements, news sentiment, and operational data, AI can flag inconsistencies and provide a more authentic assessment of a company’s green credentials. ⚖️

Moreover, AI facilitates the development of personalized green investment products. By understanding individual investor preferences for specific environmental themes (e.g., clean energy, water conservation, circular economy), AI can curate customized portfolios that reflect these values. This personalization not only enhances investor engagement but also directs capital more effectively towards areas of greatest environmental impact. The integration of AI in green investing is thus accelerating the shift towards a more sustainable global economy by making green finance smarter, more transparent, and more responsive to the urgent challenges of climate change and environmental degradation. 🔄

Frequently Asked Questions (FAQs) ❓

AI in Sustainable Finance

1. What is the role of AI in sustainable finance?

AI revolutionizes sustainable finance by enhancing data analysis, risk modeling, and investment decision-making for environmental, social, and governance (ESG) factors.

2. How does artificial intelligence contribute to green investing?

Artificial intelligence in finance helps identify, evaluate, and manage green investments by analyzing vast datasets, assessing environmental impact, and optimizing sustainable portfolios.

3. Can AI improve the accuracy of sustainable finance reporting?

Yes, AI significantly improves the accuracy and efficiency of sustainable finance reporting by automating data collection, processing, and analysis of ESG metrics.

4. What are the benefits of using AI in sustainable finance?

Benefits include enhanced data accuracy, improved risk assessment, identification of green investment opportunities, and streamlined ESG reporting.

5. How does AI help in identifying sustainable investment opportunities?

AI analyzes diverse data sources, including satellite imagery and corporate reports, to identify companies and projects with genuine environmental and social impact.

AI ESG Ratings

6. How are AI ESG ratings generated?

AI ESG ratings are generated by machine learning algorithms that process vast amounts of structured and unstructured data to assess a company’s ESG performance and risks.

7. Are AI-driven ESG ratings more objective than traditional ratings?

AI-driven ESG ratings can be more objective as they reduce human bias and provide consistent, data-driven evaluations based on comprehensive analysis.

8. What data does AI use for ESG ratings?

AI uses various data, including corporate disclosures, news articles, social media, supply chain data, and satellite imagery, to inform ESG ratings.

9. How does AI enhance the transparency of ESG ratings?

AI can enhance transparency by allowing for more granular and traceable analysis of the underlying data and methodologies used to derive ESG scores.

10. What is the impact of AI on ESG data quality?

AI improves ESG data quality by automating validation, identifying inconsistencies, and integrating diverse data sources for a more complete picture.

ESG Risk Modeling

11. How does AI enhance ESG risk modeling?

AI enhances ESG risk modeling by integrating complex data sets, simulating various scenarios, and predicting the financial impacts of environmental and social risks.

12. Can AI predict climate-related financial risks?

Yes, AI can predict climate-related financial risks by combining climate models with financial data to assess the vulnerability of assets to climate change impacts.

13. What role does AI play in assessing supply chain ESG risks?

AI analyzes supply chain data to identify and assess ESG risks such as labor practices, environmental compliance, and resource management within a company’s operations.

14. How does AI help in quantifying ESG risks for portfolios?

AI quantifies ESG risks for portfolios by analyzing the ESG profiles of individual assets and simulating their collective exposure to various sustainability-related threats.

15. Is AI effective in identifying emerging ESG risks?

AI is highly effective in identifying emerging ESG risks by continuously monitoring vast amounts of real-time data and detecting subtle patterns or anomalies.

Artificial Intelligence in Finance

16. Beyond ESG, how else is artificial intelligence in finance being used?

Artificial intelligence in finance is also used for fraud detection, algorithmic trading, personalized financial advice, and cybersecurity.

17. What are the ethical considerations of using AI in finance?

Ethical considerations include data privacy, algorithmic bias, transparency, and accountability in AI-driven financial decisions.

18. How does AI contribute to financial stability in the context of sustainability?

AI contributes to financial stability by enabling better risk management, identifying systemic sustainability risks, and promoting more resilient investment strategies.

AI Green Investing

19. What is AI green investing?

AI green investing refers to the use of artificial intelligence to identify, analyze, and select investments that contribute positively to environmental sustainability.

20. How does AI help investors avoid greenwashing?

AI helps investors avoid greenwashing by analyzing public statements, news sentiment, and operational data to verify a company’s genuine commitment to sustainability and flag inconsistencies.